GST Calculator

Simplest way to calculate GST for your business

Cost of Goods / Services

₹0

CGST

₹0

SGST

₹0

Total Selling Price

₹0

GST Calculator

Admit it. It’s difficult to keep track of taxes. Expenses, credit, debit and on top of it all, GST. We know how hard it is to calculate GST and make sense of your taxes. That’s why we built the GST calculator, to make it easy for you.

Dukaan’s free GST calculator helps you calculate the payable monthly or quarterly GST depending on the amount. Both buyers and sellers can use our GST calculator to calculate their taxes with ease.

How it works

History of Goods and Services Tax

The Goods and Services Tax (GST) was introduced in 2017 to replace the VAT, CST, service tax, central excise duty, etc. It is levied on goods and services in the country and is collected at the point of consumption (and not point of origin). In a nutshell, it is a comprehensive, multi-stage tax.

The tax slabs for various products and services are: 0%, 3%, 5%, 12%, 18%, 28%.

GST calculation can be tricky but with a GST calculator, it can be streamlined easily.

Reform of indirect tax regime started by Vishwanath Pratap Singh with the introduction of Modified Value Added Tax (MODVAT)

The idea of a common Goods and Services Tax was given a go-ahead.

The Vajpayee government formed a task force under Vijay Kelkar to recommend tax reforms.

The Kelkar committee recommended rolling out GST as recommended by the 12th Finance Commission.

The UPA introduced the 115th Constitution Amendment Bill in the Lok Sabha to bring about the GST.

Arun Jaitley from the BJP party (elected in 2014) set a deadline to implement the GST - April 1st, 2017.

In May, the Lok Sabha passed the Constitution Amendment Bill, bringing about GST.

In August, the amendment bill was passed.

GST was launched all over India with effect from 1 July 2017

GST Components

GST Calculator

Any business, manufacturer, wholesaler and retailer can calculate GST easily with the help of the following formula:

Where GST is excluded:

GST Amount =(Value of supply x GST%)/100

Price to be charged =Value of supply + GST Amount

Where GST is included in the value of supply:

GST Amount =Value of supply - [Value of supply x {100/(100+GST%)}]

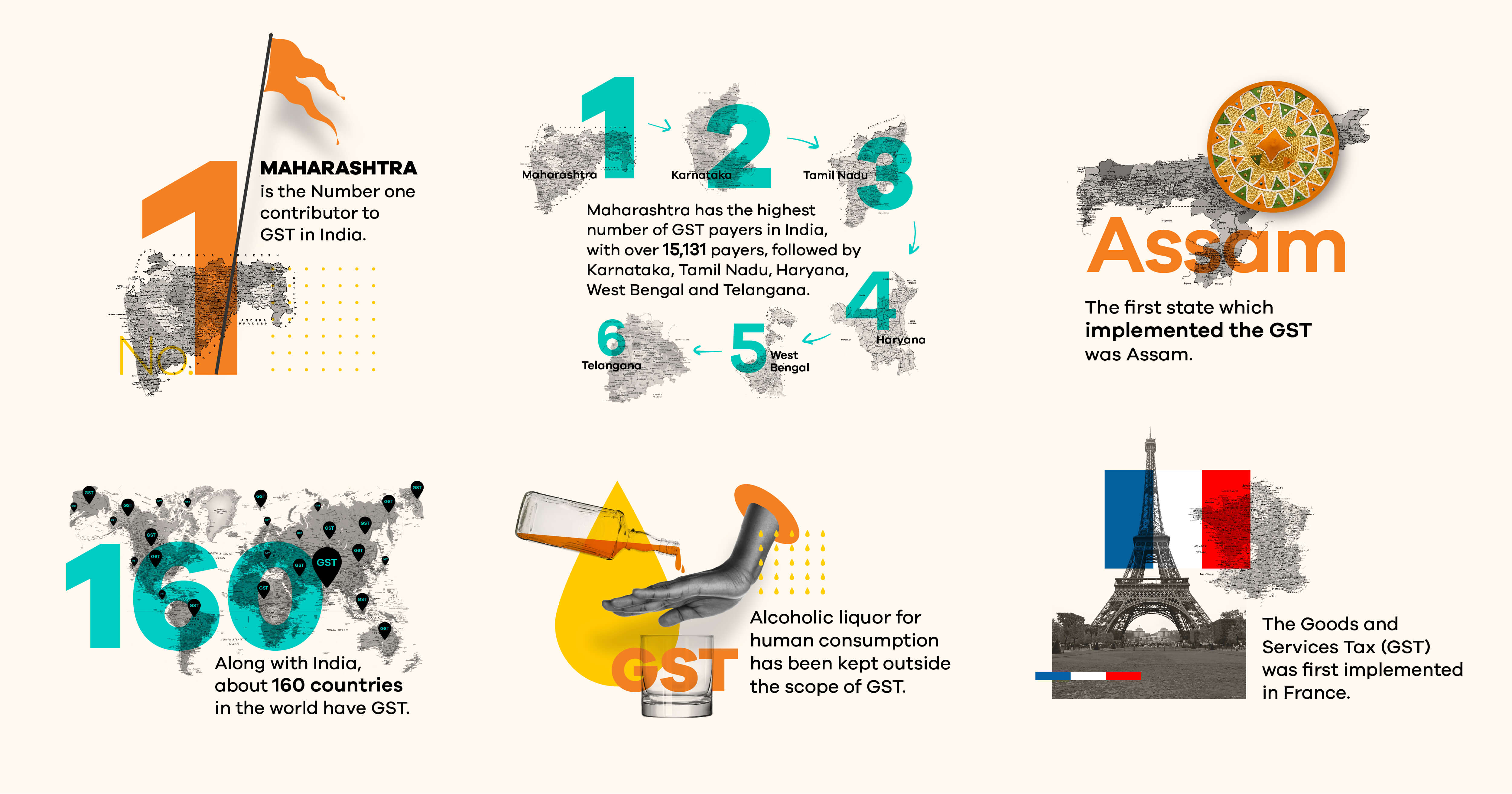

Unknown Facts about GST